As I have noted in previous articles, when looking for a company to buy, I try to find some of the following characteristics:

A stock that has fallen out of favor with investorsA stock that has a major catalyst on the horizonA company that has signaled that they are close to a bottom in their businessA compelling valuationA stock that is supported by assets that create a "floor" on the stockInsider Buying

ZipRealty (ZIPR) is a company that meets 5 of the 6 criteria listed above. The stock has fallen out of favor over the last several years as performance declined during the recession. The company has completed a major restructuring and recently returned to positive EBITDA margins. Operations of the company are further supported by a pickup in home sales in the US. There has also been significant insider buying over the past month, and the company trades at a deep discount to its competition. I believe the stock has at least 60% upside from its current price.

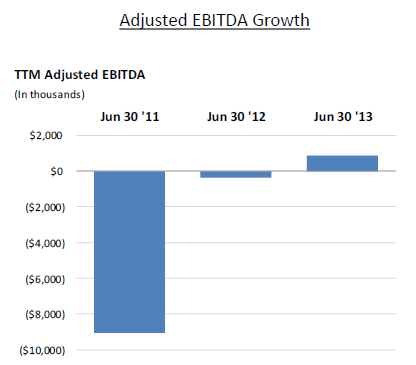

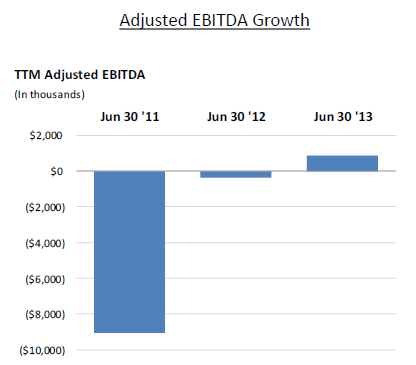

Inflection Point in Business - A Return to Positive EBITDA

The last few years have not been kind to ZIPR. The company was originally geared towards a more traditional real estate brokerage business, which leveraged the internet to display housing listings. Management over-expanded the business during the housing boom, and as home sales declined in the recession, the company saw drastic declines in operating performance. We can see that even over the last few years, revenues have declined dramatically:

| | 2012 | 2011 | 2010 | 2009 | 2008 |

Revenues ($'000's) | $73,820 | $85,149 | $118,696 | $123,130 | $107,450 |

We can also see how this performance impacted the company's stock price:

(click to enlarge)

Source: https://www.google.com/finance?q=zipr&ei=7SsgUrjwDKPz0gHx-AE

In 2011, with the company in free-fall, management began a restructuring initiative to refocus the business around their core strengths in technology, online marketing, and only their most attractive local real estate markets. ZIPR closed offices in the following markets: Fresno/Central Valley, CA, Charlotte, SC, Naples, FL, Jacksonville, FL, Miami, FL, Palm Beach, FL, Tampa, FL, Hartford, CT, Minneapolis, MN, Virginia Beach, VA, Tucson, AZ, Atlanta, GA, Raleigh-Durham, NC, Philadelphia, PA, Salt Lake City, UT, and Westchester County/Long Island, NY. The company also transitioned local operations to eight third-party brokerages in Tucson, AZ, Atlanta, GA, Raleigh-Durham, NC, Philadelphia, PA, Salt Lake City, UT, Westchester, NY, Long Island, NY and Brooklyn, NY.

As part of this restructuring, management launched the Powered by Zip program to provide third-party real estate brokers with robust, proprietary end-to-end technology solutions. We will talk about this new, software-as-a-service business later on.

The restructuring has been successful to date. Recently, with a new business model, the company returned to positive EBITDA territory:

Source: ZIPR August 2013 Investor Presentation

The company expects to remain in positive EBITDA territory, and grow EBITDA by at least 10% annually, for the foreseeable future.

This inflection point has gone mostly unnoticed by investors, mainly due to a lack of analyst coverage (more on this later). The company has transformed its business and now is prepared to grow and benefit from the pickup in housing trends. As we will talk about later, an EBITDA profitable business in this segment should be valued much higher than its current stock price.

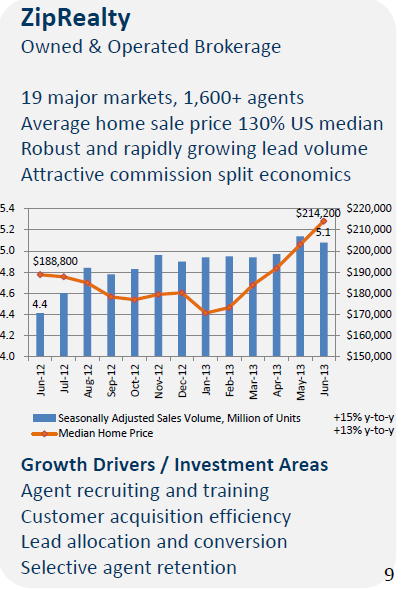

ZipRealty

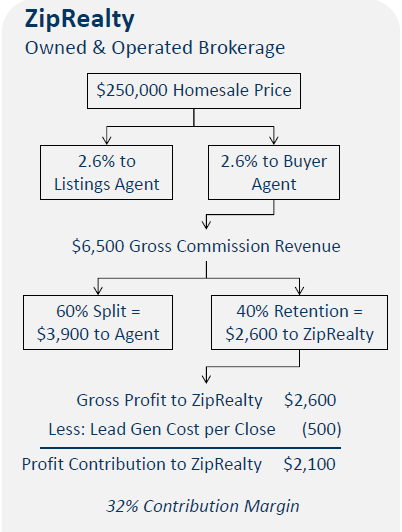

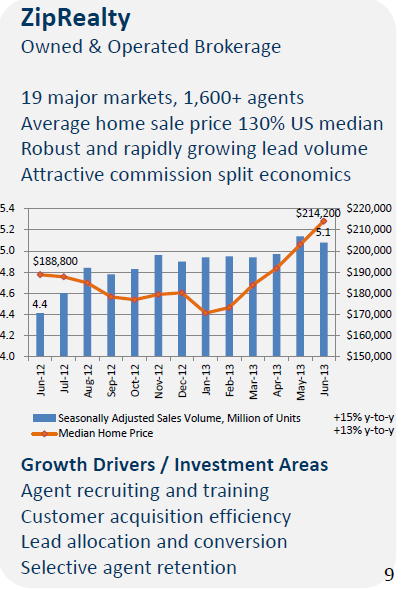

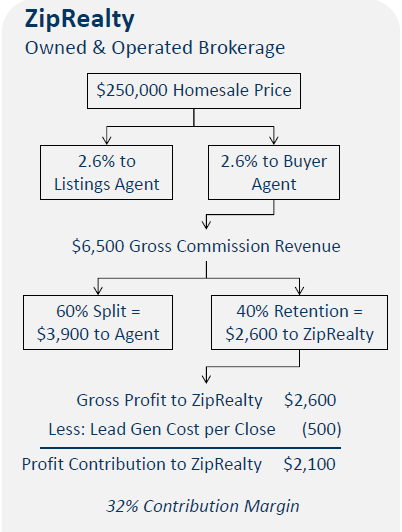

ZipRealty is the company's traditional, real estate brokerage business. The comp! any owns ! and operates brokerage business in 19 regions with over 1,500 licensed realtors. Here is a brief overview of strategy and economics of the business from the company's recent presentation:

We see from the chart that home prices have increased over the last several months, which improves the company's profitability. ZIPR then takes half of the commission, less lead generation costs, which results in 32% contribution margins.

The company's competitive advantage in this segment is its technology platform, user-friendly website, and award-winning mobile app. The company uses the site to allow consumers to do their own research, which management recently noted has become the preferred method of screening for houses by potential buyers. The company also leverages this technology in the new Powered by Zip segment.

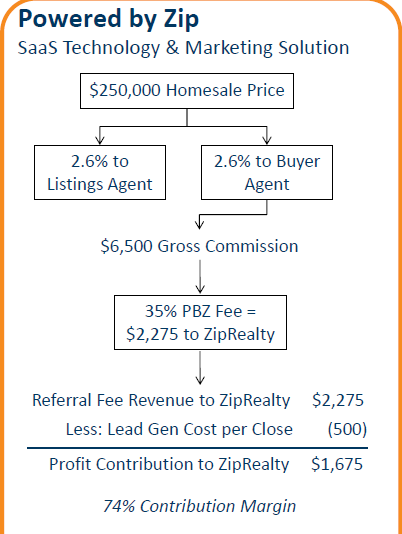

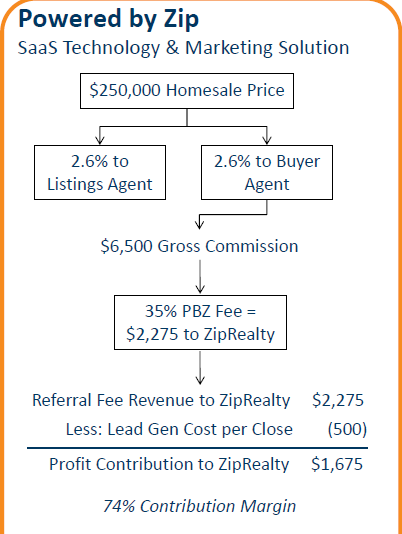

Powered by Zip

The Powered by Zip segment allows third party brokers to leverage the company's technology for their own use. This gives the individual realtors a competitive advantage and incremental referral point in their respective regions. Here is an overview of strategy and economics of this software-as-a-service business:

Competition in this segment includes Zillow (Z) and Trulia (TRLA). The company differentiates itself from the competition in multiple ways:

The focus is on serious customers, defined as those who expect to purchase or sell a home within the next six to eighteen months. ZIPR does not have the reach or traffic that Zillow or Trulia has, but they have a higher conversion rate from users. The company is also known for having the most up-to-date listings in th! e industr! y, which improves customer satisfaction with serious customers.The focus is more geared towards real estate agents than the other sites. This allows the company to better foster relationships and convert a higher percentage of users. The company provides a more user-friendly platform that its competition.The platform creates a competitive advantage for the third party users. ZIPR not only helps to generate online leads on their behalf, but also provides them access to an enterprise cloud-based application that better enables them to turn client leads into closed transactions. Zap offers these brokers crystal-clear, real-time visibility on their transaction pipeline, brokerage operations and financials, while facilitating a paperless transaction environment. Because Zap is a cloud-based application, third parties benefit from a rapid innovation cycle without the burden of expensive IT maintenance and software upgrade costs.

We have talked about the inflection point of the company as it restructured its traditional business and launched its software-as-a-service business. Let's now talk more about other catalysts for the stock…

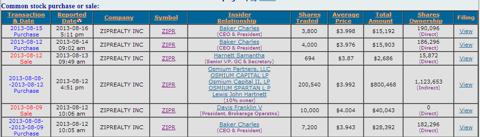

Insider Buying

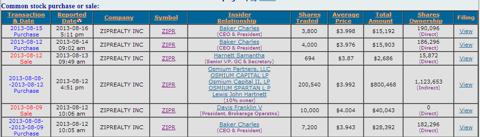

I've noted in several articles that I look for insider buying when I evaluate a name. When looking at ZIPR, insider buying has been strong over the last month:

(click to enlarge)

Source: http://www.secform4.com/insider-trading/1142512.htm

We have seen over 200,000 shares purchased by insiders (avg. volume of 45K shares traded daily and 21MM total shares outstanding) over the past month. These purchases have been made by both the CEO and Osmium Partners (2nd largest shareholder who already owns over 2.5MM shares). These purchases give me even more conviction on the prospects of ZIPR going forward.

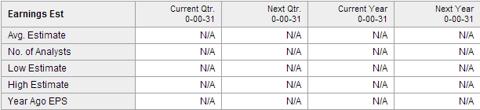

Lack of Analyst Coverage

Another thing I like to see in a stock is a lack of analyst coverage. This is for two reasons:Lack of ! coverage creates a lack of both knowledge and consensus on the company. This creates an opportunity for analysts to do their own work, which can cause a short-term "information arbitrage" vs. the overall market.Increased sell-side coverage can be a catalyst - as coverage increases, more investors will understand the story, which could create greater demand for the stock.

When looking at ZIPR, Yahoo finance shows no analyst coverage:

(click to enlarge)

Source: http://finance.yahoo.com/q/ae?s=ZIPR+Analyst+Estimates

Furthermore, on the company's latest earnings call, there were no questions from sell-side analysts.

I believe sell-side coverage could begin in the near future for multiple reasons:

High-flyers Zillow and Trulia already have expanded coverage (10 analysts and 8 analysts covering each respective name). There is much overlap between the companies, making coverage of ZIPR easier to implement.As the economy and housing picks up, demand for housing-related names will increase, creating a justification for the sell-side to begin coverage.The company has been making the rounds at small-cap conferences (3 conferences attended so far this year) which gets the story out to the analyst community and will create greater demand for coverage.

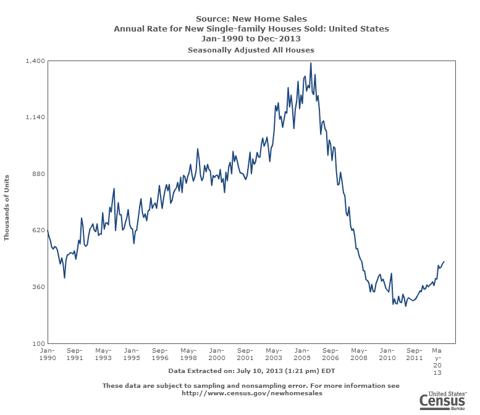

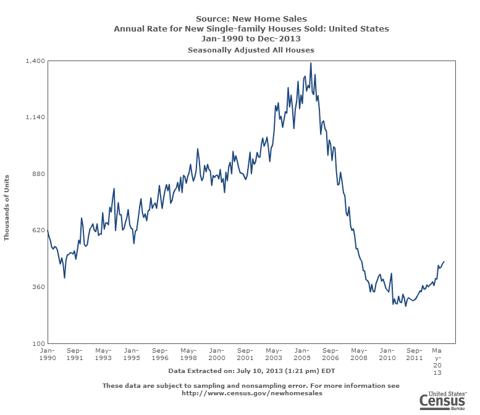

New Home Sales as a Catalyst

New home sales are the biggest driver for the real estate brokerage industry since it is a commission-based industry. Home prices are the other major driver, but we noted above that home prices have recently increased. As for sales, the US has recently seen a stabilization/pickup in new home sales, which should be a catalyst for the real estate brokerage industry, and therefore ZIPR, going forward.

Source: US Census Bureau

We see in this chart that: 1. We are under the long-term av! erage of ! annual new home sales, and 2. We have seen an inflection point upward. Both of these facts should help support the real estate brokerage industry, and ZIPR, going forward.

Balance Sheet

The company has a clean balance sheet, with $13MM in cash (14% of market capitalization) and no debt. In the company's most recent 10-K, management highlighted the company's liquidity position:

"We believe that our current cash, cash equivalents and short-term investments will be sufficient to fund cash used in our operations, restructurings and capital expenditures for at least the next twelve months. Our future capital requirements will depend on many factors, including our level of investment in technology and online marketing initiatives, our rate of growth in our local markets and in expanding our Powered by Zip broker referral network and possible litigation settlements and legal fees. Although there are signs that an economic recovery may be underway, if the recent depressed macroeconomic environment and residential real estate market continues without recovering or worsens, we may have a greater need to fund our business by using our cash, cash equivalent and short-term investment balances, which could not continue indefinitely without raising additional capital. We currently have no bank debt or line of credit facilities. In the event that additional financing is required, we may not be able to raise it on terms acceptable to us or at all. If we are unable to raise additional capital when desired, our business and results of operations will likely suffer."

I take this statement as support that the company has adequate cash on hand for operations (this is a 10-K so they are going to protect themselves and be conservative with their statements). It is also possible for the company to take on a revolver to finance operations if necessary, without issuing new shares.

Valuation

We have already reviewed the various catalysts for the company's stock. Now, let's take a look ! at its va! luation compared to the competition:

| | EBITDA | Enterprise Value | EV/EBITDA | EV/Sales | EBITDA Margin |

Z | $20MM | $3.5B | 175.0x | 32.0x | 18.2% |

TRLA | ($5MM) | $1.1B | N/A | 15.5x | -7.1% |

ZIPR | $2MM | $80MM | 40.0x | 1.0x | 2.5% |

I will say that ZIPR, considering it is a hybrid business model, will most likely always trade at a discount to Z and TRLA, but the comparative analysis shows that ZIPR is significantly undervalued compared to the other two companies. Furthermore, considering EBITDA has such a small base and just returned to positive territory, we could see big increases in EBITDA over the next several years. Considering the business model, let's take a look at EBITDA sensitivity based on revenue:

| | | Annual Revenue ($MM) | |

| | $80 | $90 | $100 | $110 | $120 | $130 |

EBITDA ($MM) | $2 | $6 | $10 | $14 | $18 | $23 |

For my valuation, I am assuming revenues grow back to at least $110MM (still below 2010 levels). I am using a 10.0x EV/EBITDA multiple, which equates to a $7.25 price target (60% upside from current price. This also equates to a 1.2x EV/Sales multiple, which makes sense considering sales are now becoming more profitable, so expansion of the EV/Sales multiple could occur. These multiples are still well under the valuations of Z and TRLA.

Longer-term, I think the company will get to ! $150MM in! sales and at least $25MM in EBITDA (as the company expands they will have to reinvest in technology). This gives us an upside target (on a blended valuation of the 10.0x EV/EBITDA and 1.5x EV/Sales multiples) of $11.50 (150% upside).

My downside target is $90MM in sales and $6MM in EBITDA, and a $3.50 price target (20% downside). This gives us a 3-to-1 risk-to-return ratio on our intermediate price target and a 7.5-to-1 risk-to-reward ratio on our longer-term target.

Risks

Risks for the company include:

Economic Sensitivity - as we said above, the company is dependent of new home sales and increased home prices. A reversal in economic growth would be negative for the company.Inability to grow the Powered by Zip Segment.Overexpansion - as the company did during the housing boom.Higher-than-expected technology costs.

Catalysts

Catalysts for the company include:

A pickup in the economy and home sales.Increased home prices.Increased sell-side coverage.Market-share gains.

Conclusion

ZIPR has several company-specific catalysts and has reached on inflection point in both its restructuring and overall business. The company is also supported by improving trends in the industry. Using conservative multiples, as compared to the company's competition, I am using a $7.25 price target on the stock, with a longer-term target of $11.50. I believe the downside target is $3.50. I am encouraging investors to buy the stock now at its current price level.

Source: Flying Under The Radar, But Not For Long: ZipRealty Has 60% Upside

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

) early on Monday, giving the oil and natural gas distribution company a bullish rating due to its low-risk cash flows.

) early on Monday, giving the oil and natural gas distribution company a bullish rating due to its low-risk cash flows.  Getty Images You've all seen the bumper stickers -- maybe you even have one on your car -- "We're spending our kids' inheritance." But funny as the sticker is, and as much as you might share the sentiment on occasion, the truth is that most Americans of retirement age say they aren't doing anything of the sort. That's the upshot of a new survey from Bankrate.com (RATE) subsidiary Interest.com, which recently polled Americans ages 18 to 59, asking whether they expect to receive an inheritance from their elders at some point in their lifetimes. And then they polled the folks bearing the bumper stickers... and came to a pretty startling conclusion: Barely 1 in 4 Americans under the age of 60 have any hope of ever inheriting anything from anybody. But nearly 2 out of 3 Americans age 60 and over say that yes, indeed, they have been saving, and one of these days, their heirs are going to benefit. What We Have Here Is a Failure to Communicate A 2011 study conducted by the Boston College Center for Retirement Research estimated that U.S. retirees have built up an astounding $8.4 trillion dollars worth of inheritable wealth. Baby Boomers have benefited from giveaways to the tune of $2.4 trillion already, but this still leaves $6 trillion more waiting to be handed out. So on one hand, according to Interest.com, 64 percent of the folks with the dough say they expect to have enough money left over at the end of their lives to bequeath it to their heirs. Yet on the other hand, 27 percent of Americans who might inherit that money don't think they'll ever see any of it. Why not? The bumper stickers may be one reason. When enough people start joking about planning to spend what they've got on themselves -- especially in an economy like this one, when that may be their only option -- you can hardly blame the kids for beginning to believe them. Or perhaps the kids may not be expecting to receive an inheritance because they simply don't know there's any money to inherit. Interest.com notes that "older parents may ... be reluctant to share their financial situation with children, not wanting to raise expectations." The Best Intentions But a third possibility also bears consideration: Maybe the kids are right. According to the Centers for Disease Control, life expectancy in the U.S. has increased by 30 years over the past century -- lengthening the amount of time a retiree's nest egg must last to permit any inheritance to take place. The Social Security Administration estimates that a man who's 60 today will, on average, live to see his 81st birthday. A woman will likely live past 84. A lot can happen over 20 years. It may well be that, as a whole, retirees have "$6 trillion" saved up. And maybe they really do to hand this money down to their heirs. Still, you have to figure that, just as in society at large, an awful lot of this money is concentrated in the hands of relatively few individuals -- "the retiree 1 percent," you might call them. Meanwhile, as mentioned here on DailyFinance before, 60 percent of American workers ages 55 and older have saved less than $100,000 for retirement. Even with the help of Social Security and pensions, it's not going to be easy to stretch $100,000 over a 20-year retirement. Even if the remaining 40 percent of the population is a bit better off, it may prove simply, fiscally impossible for 60 percent of the population to make any significant bequests. And as for the 64 percent who nonetheless insist that they plan to pass some wealth down to their heirs? A lot of them may be overly optimistic about their assets, or overly pessimistic about how long they'll live. Either way, it may end up being the thought that counts.

Getty Images You've all seen the bumper stickers -- maybe you even have one on your car -- "We're spending our kids' inheritance." But funny as the sticker is, and as much as you might share the sentiment on occasion, the truth is that most Americans of retirement age say they aren't doing anything of the sort. That's the upshot of a new survey from Bankrate.com (RATE) subsidiary Interest.com, which recently polled Americans ages 18 to 59, asking whether they expect to receive an inheritance from their elders at some point in their lifetimes. And then they polled the folks bearing the bumper stickers... and came to a pretty startling conclusion: Barely 1 in 4 Americans under the age of 60 have any hope of ever inheriting anything from anybody. But nearly 2 out of 3 Americans age 60 and over say that yes, indeed, they have been saving, and one of these days, their heirs are going to benefit. What We Have Here Is a Failure to Communicate A 2011 study conducted by the Boston College Center for Retirement Research estimated that U.S. retirees have built up an astounding $8.4 trillion dollars worth of inheritable wealth. Baby Boomers have benefited from giveaways to the tune of $2.4 trillion already, but this still leaves $6 trillion more waiting to be handed out. So on one hand, according to Interest.com, 64 percent of the folks with the dough say they expect to have enough money left over at the end of their lives to bequeath it to their heirs. Yet on the other hand, 27 percent of Americans who might inherit that money don't think they'll ever see any of it. Why not? The bumper stickers may be one reason. When enough people start joking about planning to spend what they've got on themselves -- especially in an economy like this one, when that may be their only option -- you can hardly blame the kids for beginning to believe them. Or perhaps the kids may not be expecting to receive an inheritance because they simply don't know there's any money to inherit. Interest.com notes that "older parents may ... be reluctant to share their financial situation with children, not wanting to raise expectations." The Best Intentions But a third possibility also bears consideration: Maybe the kids are right. According to the Centers for Disease Control, life expectancy in the U.S. has increased by 30 years over the past century -- lengthening the amount of time a retiree's nest egg must last to permit any inheritance to take place. The Social Security Administration estimates that a man who's 60 today will, on average, live to see his 81st birthday. A woman will likely live past 84. A lot can happen over 20 years. It may well be that, as a whole, retirees have "$6 trillion" saved up. And maybe they really do to hand this money down to their heirs. Still, you have to figure that, just as in society at large, an awful lot of this money is concentrated in the hands of relatively few individuals -- "the retiree 1 percent," you might call them. Meanwhile, as mentioned here on DailyFinance before, 60 percent of American workers ages 55 and older have saved less than $100,000 for retirement. Even with the help of Social Security and pensions, it's not going to be easy to stretch $100,000 over a 20-year retirement. Even if the remaining 40 percent of the population is a bit better off, it may prove simply, fiscally impossible for 60 percent of the population to make any significant bequests. And as for the 64 percent who nonetheless insist that they plan to pass some wealth down to their heirs? A lot of them may be overly optimistic about their assets, or overly pessimistic about how long they'll live. Either way, it may end up being the thought that counts.

Getty Images For the historically-minded, the political battles of the last few years may have induced an especially vertiginous bout of deja vu. After all, many of the big debates currently roiling our government -- including those over the minimum wage, health care, college tuition and unemployment -- are nothing new. For decades, politicians and pundits have hashed over these topics, arguing over the appropriate breadth and depth of America's social safety net. On Salon, Paul Buchheit offers an interesting rundown of government policies that hurt children, students, the elderly, wage earners, women, minorities, the sick and disabled, and the homeless -- a collection of constituencies that Buchheit calls "the eight biggest victims of America's predatory capitalism." Very succinctly, but with a great deal of solid evidence, he lays out his argument that, over the past few decades, the United States has de-invested from these groups ... with appalling results. There's a lot of room to disagree with Buchheit. Among other things, his categories have a great deal of overlap, and one could argue that he cherry-picks a great deal of his evidence. On the other hand, it's also hard to ignore America's recent attempts to balance the budget by slashing holes in the social safety net. Buchheit's article is a reminder that governmental "savings" rarely come without a cost -- and that the ones left holding the bill are often the people who have the most to lose.

Getty Images For the historically-minded, the political battles of the last few years may have induced an especially vertiginous bout of deja vu. After all, many of the big debates currently roiling our government -- including those over the minimum wage, health care, college tuition and unemployment -- are nothing new. For decades, politicians and pundits have hashed over these topics, arguing over the appropriate breadth and depth of America's social safety net. On Salon, Paul Buchheit offers an interesting rundown of government policies that hurt children, students, the elderly, wage earners, women, minorities, the sick and disabled, and the homeless -- a collection of constituencies that Buchheit calls "the eight biggest victims of America's predatory capitalism." Very succinctly, but with a great deal of solid evidence, he lays out his argument that, over the past few decades, the United States has de-invested from these groups ... with appalling results. There's a lot of room to disagree with Buchheit. Among other things, his categories have a great deal of overlap, and one could argue that he cherry-picks a great deal of his evidence. On the other hand, it's also hard to ignore America's recent attempts to balance the budget by slashing holes in the social safety net. Buchheit's article is a reminder that governmental "savings" rarely come without a cost -- and that the ones left holding the bill are often the people who have the most to lose.

AP

AP