As expected there was no letdown for Micron's (MU) Analyst Event Monday afternoon. The narrative coming from management and the plans it has for shareholders was literally the best you could hear. There was very little not bullish.

This therefore makes it hard to come at it from a balanced perspective. However, using my agenda from last week and comparing it to the actual agenda of Monday should help in keeping the sentiment in check and allow the narrative to speak for itself. That being said I'd like to go through my agenda in reverse order as it all builds into each other and into the headlining story.

So here's my agenda, now reversed:

3D XPoint sampling and ramping The next chapter in NAND market dynamics DRAM market dynamics Record earnings Net cash positive 3D XPoint

3D XPoint was mentioned 25 times during Monday's event and got me excited each time, hoping more information would be shared. What we gleaned from the presentation was a few things.

The first was Micron's willingness to consider it a pillar in its memory portfolio. They referred to is as the third product in their portfolio which also included DRAM and NAND. Now of course no one else has 3D XPoint as it was a joint venture with Micron and Intel (INTC), but still continued to drive home the portfolio is unique to all memory suppliers. Though, that's not something I'm impressed with until 3D XPoint shows its true colors.

On that topic, I was looking to hear the value proposition from Micron on why enterprise customers should care about 3D XPoint and therefore why shareholders should care about it. Without being very detailed we did hear from Sumit Sadana, Micron's Chief Business Officer, on how this looks:

...Having the ability to use 3D XPoint to expand the addressable memory for these [server] processes is so important because it actually gives you a bigger payoff and performance than simply going to the next version of the processor or faster speed of processor alone. Future processors are going to allow for more memory to be attached to the processor and that is going to be another driver of average capacity in these servers.

So perhaps Micron sees the next evolution in server processing and has already claimed stake to this new tier in the memory stack. As also discussed during the event, server demand is the company's priority as this is where much of the memory demand will come in the next two-to-three years. Furthermore, AI training server environments will require six times the DRAM and two times the NAND of conventional servers in a database. Therefore, finding another tier in the server as far as memory goes could be a huge opportunity.

Sumit went on to say he isn't going to reveal more as Micron is working with customers and doesn't want to reveal too many competitive secrets. Boooo.

But Scott Doboer, Chief Technology Officer, discussed a little more about the technology and if what he said here is true, then Micron needs to get this to market soon:

...We continue to focus on scaling technology farther for that high-performance line of memory products. 3D XPoint will continue to scale. I talked about second-generation [3D XPoint] today there is no obvious limitations in being able to continue to scale that technology.

I mean that's really the entire difficulty with memory; scaling it and making it faster, denser, and cost less. But to cut to the chase on 3D XPoint, the execs talked about this technology's second generation moving to manufacturing now and will see launching of these products in the latter part of 2019.

So does the timeline goal post keep moving? Sure feels like it but I hope management knows what it's doing on this front because it would sure be disheartening to hear a competitor coming out with a competitive or better technology while also being ready next quarter. Basically, not much for the market to chew on to move the stock valuation in any which direction, it's going to have to be one of those see-it-to-believe-it situations.

DRAM And NAND Market Dynamics

This topic was the core, or at the least, very much shared the core of the afternoon. Each executive had much to say in the way of future demand of both DRAM and NAND, particularly DRAM. As I alluded to before server and AI has been a key driver in the market's demand for memory.

Management continued to give 2021 time frames throughout its presentation and it gave me pause: is this because it believes between now and 2021 there will be a lull before it picks back up so they used a longer time frame to average it? Or is it because it can see further out than it once has?

If it's the latter, then anyone invested in this company better stick around till at least then. I don't think it's the former simply because there's no logical reason demand would dip when there is no room to slow growth in the data center and in the AI world as machine learning, cloud computing, autonomous (not just driving) technology pushes ahead faster than it ever has. It truly feels like data is the new fuel of today. CEO Sanjay Mehrotra said as much as he gave concluding remarks:

Great market opportunities for our industry, fundamentals are strongest ever and we believe that these are here to stay in terms of great demand being driven by the data economy today, as well as stabilizing supply, both for DRAM and NAND.

Hello? Anyone out there? Wall St, is that coming across the air waves clearly?

Now, if you were thinking my article's title had to do with the $10B buyback program the company will kick off in fiscal 2019 - let me tell you - what Sanjay said, as I quoted above, is the reason why the company is confident enough to start a capital return program. It's not because they have great cash flow or have less debt, it's because the memory market is not the memory market of two or three years ago. This memory demand is "here to stay" and while it may ebb and flow in terms of pricing, demand will be sustained through further technological advancements to feed the data economy; the data monster.

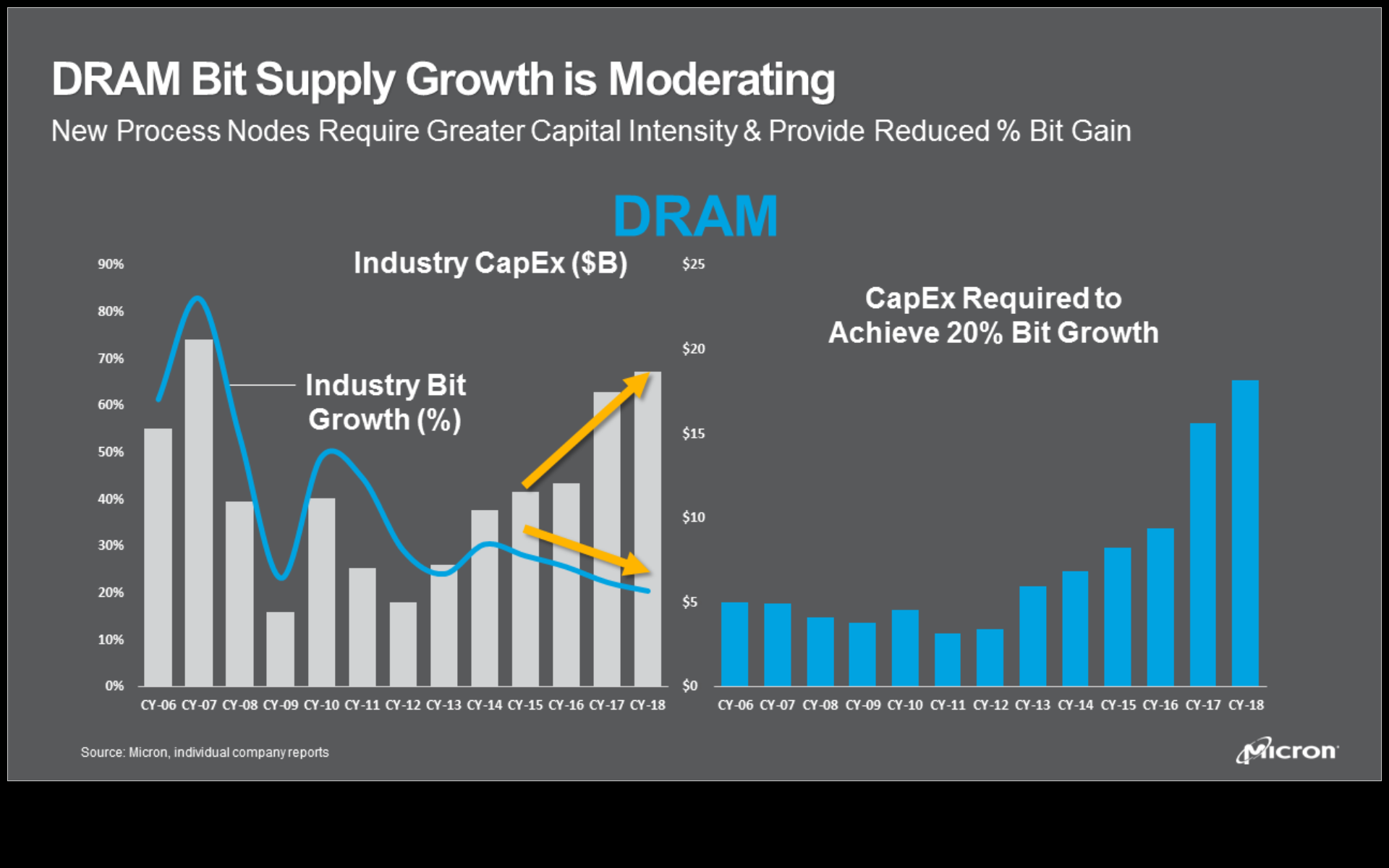

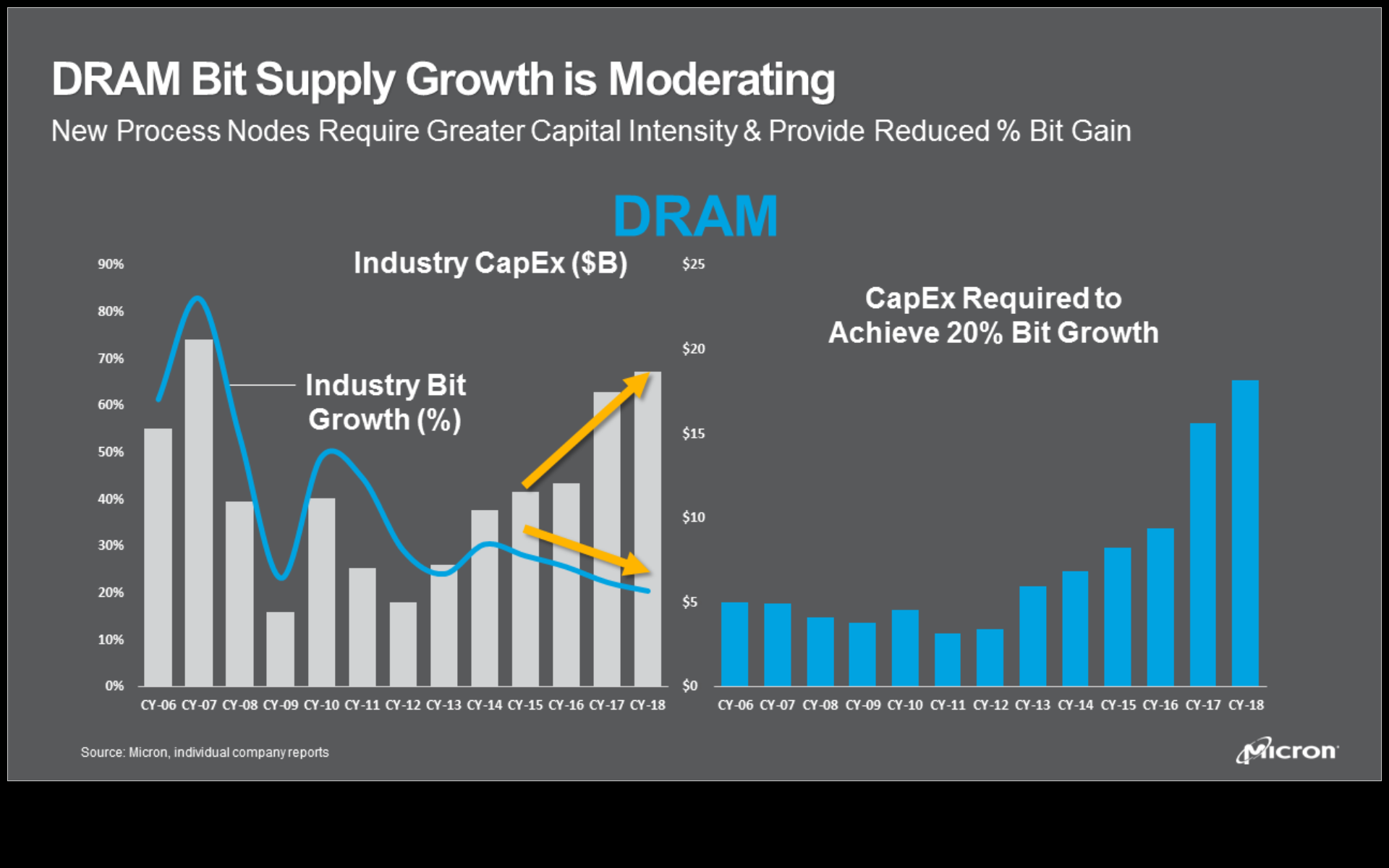

To further solidify allow me to share the 20% DRAM bit growth and 40% NAND bit growth the company's expects for the industry's bit supply.

The key is the company does not see this trend separating any time soon. As capex requirements to achieve bit growth continues to rise, bit growth sequentially decreases over the years. This is due to technology node transitions becoming increasingly difficult while producing less bit growth but costing more.

Now, how did this compare to my expectations?

...Management should talk about ... and reinforce the situation we all are seeing in pricing: analysts are wrong as the market has remained resilient in demand and pricing. The market's reaction could initially be bullish but it's going to take more than just this topic to keep it rallying.

What management discussed was above and beyond what I expected and I was quite amazed how strong it pushed the future expectations of the memory industry. Not only is this current demand here to stay but the supply of bits is set to be stabilized - said another way: no oversupply by Micron or the other DRAM suppliers. Where are all those wafer expansion expectations coming from?

I was mostly surprised at the 2021 projections, which just a year or two ago would have been laughable because of the inability to see that far down the road. Today though it's not hard to understand the demand is real and isn't slowing down.

Record Earnings

Well, I have to take a mea culpa here. I said I didn't expect a preannouncement, but that's exactly what the company issued early Monday morning, well before the event itself. And this preannouncement was even more of an upgrade from last quarter's preannouncement. This quarter they exceeded EPS guidance by 11% whereas last quarter the update was around 6%. CFO David Zinsner attributed some of this to the $150M hit it expected to take due to the nitrogen issue at the beginning not being nearly as impactful. This of course doesn't make up for all of the midpoint to midpoint upgrade of $350M in revenue though - so clearly Micron executed very well this quarter.

However, I was right about the market's expectation for this to be a slim chance as the stock was up 3.5-4% on Monday after the press release. Honestly, though, I don't have more to say on this topic because I expected the company to talk about the current quarter and how it's seeing it shape up - but I suppose I'll have to call a spade a spade and say a preannouncement does that pretty well.

What I will add though is this quarter-over-quarter growth looks to continue into next quarter with all of this "excellence" talk, which we'll know full well come June 28th at the next earnings call.

Net Cash Positive

Here's where I was focused on Monday. At one point I got a little discouraged [see 4:03PM] as I saw time running out and Manish Bhatia, EVP of Global Operations was just getting up to bat. But, Micron didn't disappoint here either and sent David up to the plate to talk about how he saw the financials today and in the future.

My interest was in the balance sheet because achieving the goal of being cash neutral opens up a lot of doors for credit upgrades, capital return programs, and financial flexibility for investments elsewhere. David got to the point and told us this:

I suspect in the third quarter we will be [cash positive]. The only thing that would inhibit us from getting there is the redemptions on converts, which we're cash settling at this point. So it��s possible. Although, unlikely that we wouldn��t make it...

My take was nothing more than de-levering would take place for the remainder of fiscal 2018 and in fact I went so far as to say calendar 2018; then a capital return program would begin, first with a buyback and then with a dividend. However, Micron signaled it's confident enough to run the plan I just laid out in fiscal 2018 and fiscal 2019, not calendar years. So the plan is to continue de-leveraging to the end of FY2018.

And of course, as many of us are aware, to initiate a $10B buyback program starting in FY2019 utilizing 50% of free cash flow to do so. This is quite amazing, not only in size but also in the quicker timeline than I expected.

If we take the first two quarter's free cash flow of $3.9B and use a slightly higher number than Q2's FCF and extrapolate it out to the end of the fiscal year we get $8.5B. In all likelihood the company generates closer to $10B in FCF in FY2019. Taking 50% of this FCF - according to the commentary to return 50% of FCF to shareholders - we get $5B, which means the company can purchase 83.3M shares or close to 7% of itself at $60 a share just in one year.

Tell me management doesn't think its shares are undervalued even at current prices and at prices in FY2019 - considering they gave the market a three month head start. I may have been off by about three or four months on the plan but I was right about this: "I ... see the market reaction as neutral to slightly bearish. This leaves the door open for a surprise in the positive direction, however." Tuesday's market action says it all, up nearly 9% at one point and closed up 6.4% on nearly triple the average volume.

Catalyst Of The Year?

This could have been the catalyst of the next three years with the way management talked up the memory market. Demand drivers here to stay? Bit growth moderating? What other bullish narrative is the market waiting for? Not to mention management talked about everything I expected them to, which is a plus from a shareholder friendly aspect.

The biggest vote in this direction is the company putting its money where its mouth is with a $10B capital return program in the vein of 50% FCF allocation. It doesn't get too much more bullish than that.

Fears of China were slapped down repeatedly by talking about how much it costs to continue making leading edge memory as well as how the price of admission is continuing to soar, let alone the IP needed. So the bear thesis becomes further and further a fairy tale while the industry as a whole appears to be moving in the direction Micron's management is narrating.

I'd like to thank all my followers, new and old, for joining me in my live blog on Monday afternoon as we followed the event. It was enjoyable to be a journalist for you and to hear your thoughts in as close to real-time as possible.

If you'd like to be made aware of my opinion and analysis in the future on Micron and other tech companies, then I encourage you to follow me by clicking the "Follow" link at the top of this page next to my name.

Subscribers Got A First Look

I told my subscribers about this opportunity in Micron through my service's chat room as well as my podcast before this article was published. Not only were they aware but they also were given the strategy to capitalize on it, something I don't share with my public readers in articles like the one you just read. To be made aware of opportunities like this, along with the strategy to profit from it, you need to join me in my service, Tech Cache. My service discusses tech and tech-related companies and the opportunities therein because the growth your portfolio needs is in tech. Right now, you can try it risk-free with a 2-week free trial!

Disclosure: I am/we are long MU, INTC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Nexeo Solutions (NASDAQ:NXEO) has been given a consensus rating of “Hold” by the six analysts that are currently covering the firm, Marketbeat Ratings reports. One research analyst has rated the stock with a sell rating, three have given a hold rating and two have issued a buy rating on the company. The average twelve-month target price among analysts that have updated their coverage on the stock in the last year is $11.17.

Nexeo Solutions (NASDAQ:NXEO) has been given a consensus rating of “Hold” by the six analysts that are currently covering the firm, Marketbeat Ratings reports. One research analyst has rated the stock with a sell rating, three have given a hold rating and two have issued a buy rating on the company. The average twelve-month target price among analysts that have updated their coverage on the stock in the last year is $11.17.

Mcrae Capital Management Inc. decreased its stake in shares of The Bank of New York Mellon (NYSE:BK) by 6.1% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 15,435 shares of the bank’s stock after selling 1,000 shares during the quarter. Mcrae Capital Management Inc.’s holdings in The Bank of New York Mellon were worth $795,000 at the end of the most recent reporting period.

Mcrae Capital Management Inc. decreased its stake in shares of The Bank of New York Mellon (NYSE:BK) by 6.1% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 15,435 shares of the bank’s stock after selling 1,000 shares during the quarter. Mcrae Capital Management Inc.’s holdings in The Bank of New York Mellon were worth $795,000 at the end of the most recent reporting period.  Findlay Park Partners LLP acquired a new stake in Bancolombia (NYSE:CIB) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 43,300 shares of the bank’s stock, valued at approximately $1,819,000.

Findlay Park Partners LLP acquired a new stake in Bancolombia (NYSE:CIB) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 43,300 shares of the bank’s stock, valued at approximately $1,819,000.