One consumer goods company has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

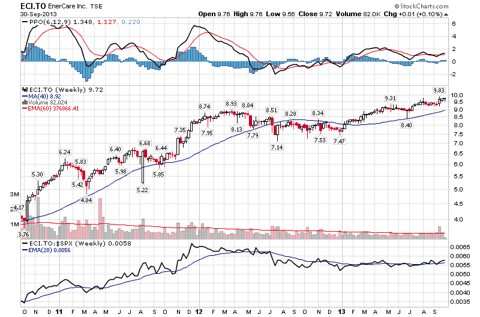

EnerCare (TSX:ECI) engages in water heater rental and sub-metering businesses. EnerCare owns a portfolio of approximately 1.2 million installed water heaters and other assets, rented primarily to residential customers in Ontario. EnerCare also owns EnerCare Connections Inc., a sub-metering company, with metering contracts for condominium and apartment suites in Ontario, Alberta and elsewhere in Canada.

[ Enlarge Image ]

[ Enlarge Image ]

Insider Buying During the Last 30 Days

John MacDonald purchased 2,500 shares on Sept. 17 to 30 and currently holds 35,175 shares or less than 0.1% of the company. John MacDonald was appointed president and chief executive officer of EnerCare in November 2006. John MacDonald increased his holdings by 7.7% in September.Michael Rousseau purchased 10,000 shares on Sept. 24 to 25 and currently holds 10,000 shares or less than 0.1% of the company. Michael Rousseau serves as a director of the company. Michael Rousseau increased his holdings from zero shares to 10,000 shares in September.John Toffoletto purchased 2,000 shares on Sept. 30 and currently holds 4,400 shares or less than 0.1% of the company. John Toffoletto is senior vice president, general counsel and corporate secretary. John Toffoletto increased his holdings by 90.9% in September.Insider Buying by Calendar Month

Here is a table of EnerCare's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| Sep! tember 2013 | 14,500 | 0 |

| August 2013 | 400 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 4,000 | 0 |

| May 2013 | 12,100 | 0 |

| April 2013 | 0 | 0 |

There have been 31,000 shares purchased and there have been zero shares sold by insiders since April 2013.

Financials

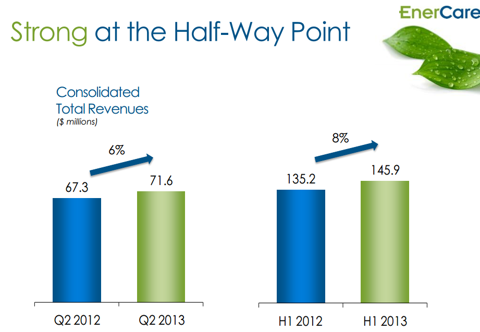

EnerCare reported the second-quarter financial results on Aug. 12 with the following highlights:

| Revenue | $71.6 million |

| Net income | $7.5 million |

| Cash | $11.5 million |

| Debt | $531.9 million |

[ Enlarge Image ]

[ Enlarge Image ]Outlook

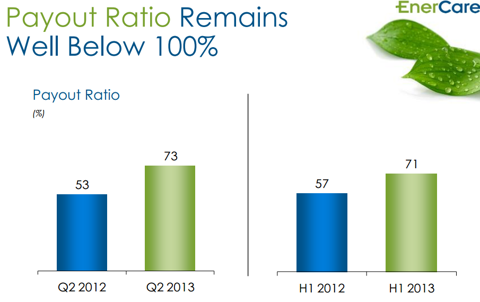

EnerCare believes that it has sufficient cash flow, cash on hand and credit available to meet its 2013 obligations, including capital expenditures, financing activities and working capital requirements for its businesses.

EnerCare intends to increase its monthly dividend to $0.058 per share, an increase of 1.8%, effective in respect of the dividend payable to shareholders of record on the applicable date in September 2013, which will be paid in October 2013. The dividend increase reflects EnerCare's strong performance in the first half of 2013, its long-term stable financial structure, recent reductions in attrition and the confidence the board has in the company moving forward.

[ Enlarge Image ]

[ Enlarge Image ]

Competition

EnerCare's competitors include Reliance Home Comfort, Newton Home Comfort and National Home Services. National Home Services is a subsidiary of Just Energy Group (TSX:JE). Just Energy Group has seen one insider buy transaction during the past six months. Jus! t Energy ! Group is trading at a P/E ratio of 4.1 and the stock has a dividend yield of 12.8%.

Conclusion

There have been three different insiders buying EnerCare and there have not been any insiders selling EnerCare during the past 30 days. Two of these three insiders increased their holdings by more than 10%.

EnerCare has a dividend yield of 7.2%. I have a cautiously bullish bias for the stock currently based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment