Alibaba Group Holding Ltd. (NYSE: BABA) stock will be priced on Thursday (Sept. 18) evening, in what could be the largest initial public offering of all time.

The Chinese e-commerce giant will reportedly price its shares between $66 and $68 each. If BABA shares are priced at the high end of that range, the Alibaba IPO price will reach roughly $21.8 billion on its first day.

The Chinese e-commerce giant will reportedly price its shares between $66 and $68 each. If BABA shares are priced at the high end of that range, the Alibaba IPO price will reach roughly $21.8 billion on its first day.

However, that total could climb much higher - as high as $25 billion - depending on how many shares the underwriters purchase following the IPO.

The company has also been targeting a valuation of $155 billion for its IPO, and analysts surveyed by Bloomberg stated that BABA could reach $200 billion shortly after the IPO.

But Money Morning's Chief Investment Strategist Keith Fitz-Gerald has his sights set much higher for BABA's valuation. In fact, he thinks Alibaba will be the world's first $1 trillion company...

Why Alibaba (NYSE: BABA) Will Reach $1 Trillion"Several years ago I made the comment that I thought Apple Inc. (Nasdaq: AAPL) had a shot at becoming the world's first $1 trillion company; now, I think Alibaba is the better bet," Fitz-Gerald said. "The company is moving aggressively to create strategic partnerships that are about Web dominance in its home market. It's already bigger than Amazon.com Inc. (Nasdaq: AMZN) and eBay Inc. (Nasdaq: EBAY) combined and is now launching an e-commerce platform in the United States called 11 Main that's going to have popular categories like fashion, home, and collectible items presorted for Western consumers."

You see, the Chinese e-commerce industry (Alibaba's "home" market) is growing at an alarming rate. It's an area that Fitz-Gerald has been following very closely, along with Money Morning's Executive Editor Bill Patalon.

BREAKING: Grab this stock for a fast 149% win BEFORE the Alibaba IPO. (It's NOT Yahoo.) Click here now.

Online-shopping in China was a $298 billion industry in 2013, easily surpassing the $263 billion that was spent in the United States last year. That made China the top e-commerce market in the world. According to the research firm yStats, China's consumer e-commerce market soared more than 60% in 2013.

And according to Patalon, that's just the start of China's growth...

"Beijing is doing all it can to fuel the advance of e-commerce," Patalon said. "China's leaders govern in part by crafting long-term plans that establish goals for the overall economy and for key sectors. Those plans also establish the policies, incentives, and catalysts needed to move those initiatives along."

"In China's 'E-Commerce 12th Five-Year Plan for 2011-2015' (that's what it's called), the Ministry of Industry and Information Technology focused on making China a true global powerhouse in e-commerce - and I mean a bona fide worldwide leader in this digital transactional realm," Patalon continued.

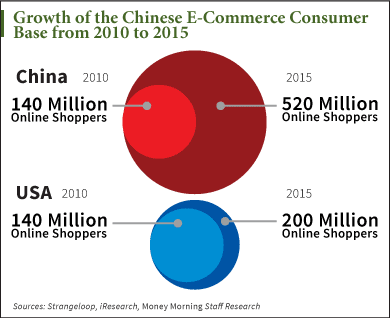

If that wasn't enough, the user growth projected in China is unheard of. By 2015, the number of Chinese e-commerce users is expected to hit 520 million - that's more than double the number expected in the United States.

Couple that growth with the fact that 80% of all online transactions in China last year took place on one of Alibaba's sites, and the growth potential for the company is apparent.

The use of mobile devices in China is also growing at an incredible rate. And once again, Alibaba is positioned to capitalize...

In 2013, Alibaba reported that its mobile sales soared 100% to 351 million units. That accounted for one-third of all global sales.

But that's just the start. According to the research firm IDC, smartphone shipments in China will top 450 million units this year.

All of those growth figures would be impressive in any market, but the fact that the growth is happening in China is notable because e-commerce in China is very different than in the United States.

"Jack Ma, Alibaba's founder and chairman, recently hinted that his company can count on an even-more-loyal audience in its home market of China than a longer established company like Amazon.com will find in its home U.S. market," Patalon said. "In an interview, Ma said that 'in other countries, e-commerce is a way to shop; in China, it is a lifestyle.'"

Editor's Note: Many investors are hoping to cash in on the Alibaba IPO by making the "obvious" move. But there's another way. I'm talking about a unique "backdoor" company that most people have never heard of before. Our research shows you can reap huge profits on this right now. Go here.

Join the conversation on Twitter @moneymorning and @KyleAndersonMM using #Alibaba.

No comments:

Post a Comment