| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

SPY STOCK PRICE CHART

177.35 (1y: +18%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73! ],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[1376283600000,169.11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[13

Associated Press

Associated Press  “It’s an anti-product conference,” Potts (left) said in an interview with AdvisorOne, “with no big banners and no formal sponsors.”

“It’s an anti-product conference,” Potts (left) said in an interview with AdvisorOne, “with no big banners and no formal sponsors.” Getty Images Ever since I was a kid, I've been obsessed with saving money. I've also been partially obsessed with the fear that I won't have enough money in retirement to live comfortably, and will wind up eating dog food or living in a halfway house when I'm old. Maybe those ideas are extreme, but the fear that I won't have enough saved for retirement has certainly gotten me to contribute regularly to my 401(k), though that's something I wish I'd started a lot earlier and saved more robustly during my working life. Maybe it was the convalescent hospitals I visited one summer to help my mom while she worked that made me a determined saver. After setting up an activity for the residents, I could walk around the convalescent home for a bit, seeing how frail and forgotten some of them were. They had the money to stay there, but it was a place I never wanted to live. However my fear of not having enough money to live comfortably in old age came about, I only really started saving for retirement at about my third job out of college. That was when pensions were being eliminated by employers, and self-directed 401(k)s were being introduced as retirement savings vehicles. I remember the financial services company representative giving us workers -- many of whom, like me, could barely afford an apartment in the bad part of town -- a speech about how we were now responsible for our retirement, and our employer would match the contributions we made. To me, that sounded like an automatic raise -- which was rare at this company -- though it was a raise I wouldn't see until I retired. Powerful and Relatively Painless Through automatic withdrawals from my paycheck, I saw the power of saving regularly and how my money compounded over time. It was an easy and relatively painless way to save because I didn't really notice the money going to my 401(k) because the money wasn't going into my checking account. You can't spend what you don't see. It also helped reinforce an earlier lesson in how automatic withdrawals can be a painless way to save money for long-term goals. I now contribute to a SEP IRA as a self-employed freelance writer, though not through automatic withdrawals, because my monthly income fluctuates. Instead, I set aside money from one client each month to put into the individual retirement account, and I send a check to my brokerage firm. There are months when I'm not as good as I should be about sending that check -- usually ones when I don't earn much from that client -- so I try to contribute the money I earn from any extra work to my retirement savings, too. I don't know if I'll ever stop worrying completely about having enough money saved for retirement, but I'm glad that I realized early how important it is. More from Aaron Crowe

Getty Images Ever since I was a kid, I've been obsessed with saving money. I've also been partially obsessed with the fear that I won't have enough money in retirement to live comfortably, and will wind up eating dog food or living in a halfway house when I'm old. Maybe those ideas are extreme, but the fear that I won't have enough saved for retirement has certainly gotten me to contribute regularly to my 401(k), though that's something I wish I'd started a lot earlier and saved more robustly during my working life. Maybe it was the convalescent hospitals I visited one summer to help my mom while she worked that made me a determined saver. After setting up an activity for the residents, I could walk around the convalescent home for a bit, seeing how frail and forgotten some of them were. They had the money to stay there, but it was a place I never wanted to live. However my fear of not having enough money to live comfortably in old age came about, I only really started saving for retirement at about my third job out of college. That was when pensions were being eliminated by employers, and self-directed 401(k)s were being introduced as retirement savings vehicles. I remember the financial services company representative giving us workers -- many of whom, like me, could barely afford an apartment in the bad part of town -- a speech about how we were now responsible for our retirement, and our employer would match the contributions we made. To me, that sounded like an automatic raise -- which was rare at this company -- though it was a raise I wouldn't see until I retired. Powerful and Relatively Painless Through automatic withdrawals from my paycheck, I saw the power of saving regularly and how my money compounded over time. It was an easy and relatively painless way to save because I didn't really notice the money going to my 401(k) because the money wasn't going into my checking account. You can't spend what you don't see. It also helped reinforce an earlier lesson in how automatic withdrawals can be a painless way to save money for long-term goals. I now contribute to a SEP IRA as a self-employed freelance writer, though not through automatic withdrawals, because my monthly income fluctuates. Instead, I set aside money from one client each month to put into the individual retirement account, and I send a check to my brokerage firm. There are months when I'm not as good as I should be about sending that check -- usually ones when I don't earn much from that client -- so I try to contribute the money I earn from any extra work to my retirement savings, too. I don't know if I'll ever stop worrying completely about having enough money saved for retirement, but I'm glad that I realized early how important it is. More from Aaron Crowe The Chinese e-commerce giant will reportedly price its shares between $66 and $68 each. If BABA shares are priced at the high end of that range, the Alibaba IPO price will reach roughly $21.8 billion on its first day.

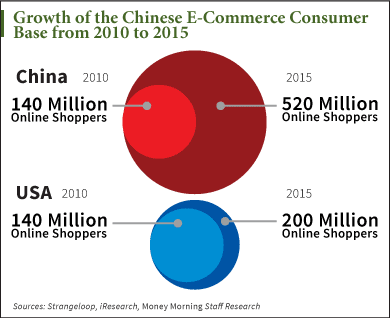

The Chinese e-commerce giant will reportedly price its shares between $66 and $68 each. If BABA shares are priced at the high end of that range, the Alibaba IPO price will reach roughly $21.8 billion on its first day.

Patrick T. Fallon/Bloomberg via Getty ImagesGeneral Electric appliances at a Lowe's store in Torrance, California. NEW YORK -- General Electric (GE), a household name for more than a century in part for making households easier to run, is leaving the home. The company is selling the division that invented the toaster in 1905 and now sells refrigerators, stoves and laundry machines. GE has increasingly focused on building industrial machines such as aircraft engines, locomotives, gas-fired turbines and medical imaging equipment -- much bigger and more complex than washers, and more profitable. "They are no longer going to be a consumer company," says Andrew Inkpen, a professor at the Thunderbird School of Global Management who has written extensively about GE. GE, based in Fairfield, Connecticut, announced Monday the sale of its appliance division to the Swedish appliance-maker Electrolux for $3.3 billion. Electrolux will still sell appliances under the GE brand in attempt to leverage the company's long history. GE has sold devices to people for its entire 122-year history, starting with the light bulb, which was invented by company founder Thomas Edison. The lighting division will stay, but it's just a tiny part of GE. Now GE will sell its products almost exclusively to other companies. The company is hoping to return to favor among investors with higher, more consistent and more predictable profits. GE is the only remaining member of the Dow Jones industrial average (^DJI), first calculated in 1896, and as recently as 2004 it was the biggest corporation in the world by market value. But GE has frustrated shareholders by underperforming both the Dow and broader stock indexes for much of the last decade. The company has been able to survive by shuffling its portfolio to shed unprofitable divisions or jump into a new, growing sector. And it has never shied away from abandoning historic businesses, like the plastics unit it started in 1912 and sold in 2007. The latest version of GE will make mostly big, complex equipment, some of which it has been making for more than a century, like power generators, and some that is new to GE, like oil and gas drilling equipment. In July the company spun off its consumer credit card business into a new company, Synchrony Financial. In recent years it has sold NBC Universal and its insurance operations and it is gradually shrinking its sprawling financial company, called GE Capital. In June GE agreed to buy the energy and power generation operations of the French engineering company Alstom for $17 billion. And over the last several years it has been acquiring companies to help it become a bigger player in oil and gas drilling equipment. Christopher Glynn, an analyst at Oppenheimer & Co., says the company now has the potential to show the strong results it was once famous for, though it still may take some time. "It's still GE, it's still huge," he says. "But this is a viable reset."

Patrick T. Fallon/Bloomberg via Getty ImagesGeneral Electric appliances at a Lowe's store in Torrance, California. NEW YORK -- General Electric (GE), a household name for more than a century in part for making households easier to run, is leaving the home. The company is selling the division that invented the toaster in 1905 and now sells refrigerators, stoves and laundry machines. GE has increasingly focused on building industrial machines such as aircraft engines, locomotives, gas-fired turbines and medical imaging equipment -- much bigger and more complex than washers, and more profitable. "They are no longer going to be a consumer company," says Andrew Inkpen, a professor at the Thunderbird School of Global Management who has written extensively about GE. GE, based in Fairfield, Connecticut, announced Monday the sale of its appliance division to the Swedish appliance-maker Electrolux for $3.3 billion. Electrolux will still sell appliances under the GE brand in attempt to leverage the company's long history. GE has sold devices to people for its entire 122-year history, starting with the light bulb, which was invented by company founder Thomas Edison. The lighting division will stay, but it's just a tiny part of GE. Now GE will sell its products almost exclusively to other companies. The company is hoping to return to favor among investors with higher, more consistent and more predictable profits. GE is the only remaining member of the Dow Jones industrial average (^DJI), first calculated in 1896, and as recently as 2004 it was the biggest corporation in the world by market value. But GE has frustrated shareholders by underperforming both the Dow and broader stock indexes for much of the last decade. The company has been able to survive by shuffling its portfolio to shed unprofitable divisions or jump into a new, growing sector. And it has never shied away from abandoning historic businesses, like the plastics unit it started in 1912 and sold in 2007. The latest version of GE will make mostly big, complex equipment, some of which it has been making for more than a century, like power generators, and some that is new to GE, like oil and gas drilling equipment. In July the company spun off its consumer credit card business into a new company, Synchrony Financial. In recent years it has sold NBC Universal and its insurance operations and it is gradually shrinking its sprawling financial company, called GE Capital. In June GE agreed to buy the energy and power generation operations of the French engineering company Alstom for $17 billion. And over the last several years it has been acquiring companies to help it become a bigger player in oil and gas drilling equipment. Christopher Glynn, an analyst at Oppenheimer & Co., says the company now has the potential to show the strong results it was once famous for, though it still may take some time. "It's still GE, it's still huge," he says. "But this is a viable reset." AR Images/AlamyYoung people have shown an interest in saving, but they're unable to follow through because debt is holding them back. The Great Recession handed millennials a huge lesson about money early in their careers: They saw how quickly the stock market can go south, how hard it can be to land and hold onto a job and how difficult it can be to pursue the American dream when you're drowning in debt. The results of the new 2014 Wells Fargo Millennial Study shows just how far millennials still have to go to achieve a level of financial well-being typically associated with adulthood. While eight in 10 millennials say the recession taught them the importance of saving for the future, only 55 percent of the 1,639 millennials surveyed have actually started saving for retirement. Those who aren't yet putting money away say they think they will be able to begin doing so at age 35 -- far later than the age financial advisers recommend opening up a retirement savings account. "They realize that the earlier they start, the more money they'll have," says Karen Wimbish, director of retail retirement at Wells Fargo (WFC). "They won't have pensions, they will probably live longer and Social Security might be a smaller part of their retirement income." But even though they grasp that reality, she says, their financial constrains make it difficult for them to actually get started doing what they know they should. Debt is their biggest albatross. Four in 10 named debt as their top concern, and just as many said they are overwhelmed by it, compared to just 23 percent of baby boomers. Debts eat into a significant amount of monthly income, too, with credit card debt claiming 16 percent of millennials' paychecks, followed by mortgage debt (15 percent); student loan debt (12 percent); auto debt (9 percent); and medical debt (5 percent). "For some of them, it's absolutely crushing," Wimbish says. Medical debt, in fact, stands out as a surprising problem for millennials. Despite their youth, many have faced significant amounts of health-related costs, which continue to dog them. Gary Mottola, research director of FINRA Investor Education Foundation, says one in three millennials has unpaid medical debt, compared to 22 percent of baby boomers. Indeed, half of the 6,865 millennials in the 2012 FINRA survey worry that they have too much debt. "This is something that's on their minds and pervades their generation," Mottola says. The Wells Fargo survey also found that it's those debts that are really holding them back. About half of millennials in the survey said more than half of their income goes directly toward paying off debt, and 56 percent said they are living paycheck to paycheck, unable to save for the future. Their top reasons for not saving for retirement include not having enough money to save (84 percent) and having more immediate priorities, like needing to pay off debt (77 percent). Another problem is that their confidence in the stock market was shaken by the recession, which could hurt them over the long run, if they keep their money in safer spots that earn lower (or no) returns. Among the 1,529 baby boomers in the Wells Fargo survey, 66 percent say the stock market is the best place to invest, while just 59 percent of millennials are willing to say the same. Their hesitancy to invest, though, might fade with time, as we move further away from the recession: Last year, just under half of millennials were willing to call the stock market the best place to invest. Even those who are invested in the stock marked tend to be putting their money in overly conservative spots, given their age and long time horizon. A significant number of millennials -- 30 percent -- say they have a quarter or less of their investments in stocks or mutual funds. Pat Pearsall-Ramey, a financial planning manager at Ernst & Young, says millennials are simply too inexperienced to know what to do with their money. "They don't know how to make investment decisions. They are new to being investors, and they overreact," she says. They might watch the news and see a worrisome story and sell their stocks, for example, whereas a more experienced investor would know that it's usually best to hold shares (within a diversified portfolio) over longer periods. Still, as previous studies have found, Gen Yers' optimism remains strong, according to the Wells Fargo study. Seven in 10 said they are better off financially than their peers, which, statistically, cannot actually be true. A similar percentage said they expect their standard of living to exceed their parents by the time they reach retirement age. A whopping 78 percent said they are confident they could find a new, similar job within a year if they were to lose their current one. (Among baby boomers, only 58 percent said they same.) Gen Yers' best advice to others, according to Wells Fargo, is exactly what they should be following themselves, even if they currently find themselves unable to do so: Don't spend more than you earn, get educated about your personal finances and start saving for retirement now. As they've already discovered, it's easier said than done. Despite that reality, though, millennials are actually more satisfied with their finances than Gen Xers, a fact that Mottola attributes to their financial expectations being shaped by the recession. In other words, he thinks they have lower standards. Still, those deciding whether to pull out the plastic for another purchase or ramp up their 401(k) contribution instead might want to heed the warning of Mary Beth Franklin, a financial industry and retirement expert: "If you save 3 percent [of your income], retirement will be a lot like college. You'll eat a lot of ramen noodles, but you won't look as cute doing it." .

AR Images/AlamyYoung people have shown an interest in saving, but they're unable to follow through because debt is holding them back. The Great Recession handed millennials a huge lesson about money early in their careers: They saw how quickly the stock market can go south, how hard it can be to land and hold onto a job and how difficult it can be to pursue the American dream when you're drowning in debt. The results of the new 2014 Wells Fargo Millennial Study shows just how far millennials still have to go to achieve a level of financial well-being typically associated with adulthood. While eight in 10 millennials say the recession taught them the importance of saving for the future, only 55 percent of the 1,639 millennials surveyed have actually started saving for retirement. Those who aren't yet putting money away say they think they will be able to begin doing so at age 35 -- far later than the age financial advisers recommend opening up a retirement savings account. "They realize that the earlier they start, the more money they'll have," says Karen Wimbish, director of retail retirement at Wells Fargo (WFC). "They won't have pensions, they will probably live longer and Social Security might be a smaller part of their retirement income." But even though they grasp that reality, she says, their financial constrains make it difficult for them to actually get started doing what they know they should. Debt is their biggest albatross. Four in 10 named debt as their top concern, and just as many said they are overwhelmed by it, compared to just 23 percent of baby boomers. Debts eat into a significant amount of monthly income, too, with credit card debt claiming 16 percent of millennials' paychecks, followed by mortgage debt (15 percent); student loan debt (12 percent); auto debt (9 percent); and medical debt (5 percent). "For some of them, it's absolutely crushing," Wimbish says. Medical debt, in fact, stands out as a surprising problem for millennials. Despite their youth, many have faced significant amounts of health-related costs, which continue to dog them. Gary Mottola, research director of FINRA Investor Education Foundation, says one in three millennials has unpaid medical debt, compared to 22 percent of baby boomers. Indeed, half of the 6,865 millennials in the 2012 FINRA survey worry that they have too much debt. "This is something that's on their minds and pervades their generation," Mottola says. The Wells Fargo survey also found that it's those debts that are really holding them back. About half of millennials in the survey said more than half of their income goes directly toward paying off debt, and 56 percent said they are living paycheck to paycheck, unable to save for the future. Their top reasons for not saving for retirement include not having enough money to save (84 percent) and having more immediate priorities, like needing to pay off debt (77 percent). Another problem is that their confidence in the stock market was shaken by the recession, which could hurt them over the long run, if they keep their money in safer spots that earn lower (or no) returns. Among the 1,529 baby boomers in the Wells Fargo survey, 66 percent say the stock market is the best place to invest, while just 59 percent of millennials are willing to say the same. Their hesitancy to invest, though, might fade with time, as we move further away from the recession: Last year, just under half of millennials were willing to call the stock market the best place to invest. Even those who are invested in the stock marked tend to be putting their money in overly conservative spots, given their age and long time horizon. A significant number of millennials -- 30 percent -- say they have a quarter or less of their investments in stocks or mutual funds. Pat Pearsall-Ramey, a financial planning manager at Ernst & Young, says millennials are simply too inexperienced to know what to do with their money. "They don't know how to make investment decisions. They are new to being investors, and they overreact," she says. They might watch the news and see a worrisome story and sell their stocks, for example, whereas a more experienced investor would know that it's usually best to hold shares (within a diversified portfolio) over longer periods. Still, as previous studies have found, Gen Yers' optimism remains strong, according to the Wells Fargo study. Seven in 10 said they are better off financially than their peers, which, statistically, cannot actually be true. A similar percentage said they expect their standard of living to exceed their parents by the time they reach retirement age. A whopping 78 percent said they are confident they could find a new, similar job within a year if they were to lose their current one. (Among baby boomers, only 58 percent said they same.) Gen Yers' best advice to others, according to Wells Fargo, is exactly what they should be following themselves, even if they currently find themselves unable to do so: Don't spend more than you earn, get educated about your personal finances and start saving for retirement now. As they've already discovered, it's easier said than done. Despite that reality, though, millennials are actually more satisfied with their finances than Gen Xers, a fact that Mottola attributes to their financial expectations being shaped by the recession. In other words, he thinks they have lower standards. Still, those deciding whether to pull out the plastic for another purchase or ramp up their 401(k) contribution instead might want to heed the warning of Mary Beth Franklin, a financial industry and retirement expert: "If you save 3 percent [of your income], retirement will be a lot like college. You'll eat a lot of ramen noodles, but you won't look as cute doing it." .

Popular Posts: The Best Ways to Buy the Alibaba IPO5 Ways Apple Is Trying to Pump Value Into AAPL Stock5 Top Fidelity Mutual Funds to Own Recent Posts: 7 Reasons to Believe in JCP Stock Again Could Yahoo Become the Next Berkshire Hathaway? 5 Ways Apple Is Trying to Pump Value Into AAPL Stock View All Posts

Popular Posts: The Best Ways to Buy the Alibaba IPO5 Ways Apple Is Trying to Pump Value Into AAPL Stock5 Top Fidelity Mutual Funds to Own Recent Posts: 7 Reasons to Believe in JCP Stock Again Could Yahoo Become the Next Berkshire Hathaway? 5 Ways Apple Is Trying to Pump Value Into AAPL Stock View All Posts  In his words, Mike Ullman is "trying to get JCP back to being a mediocre department store that's kind of dying very slowly instead of very fast." That can't be good for JCP stock.

In his words, Mike Ullman is "trying to get JCP back to being a mediocre department store that's kind of dying very slowly instead of very fast." That can't be good for JCP stock.

177.35 (1y: +18%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73! ],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[1376283600000,169.11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[13

177.35 (1y: +18%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73! ],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[1376283600000,169.11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[13

Then on Wednesday, it was as if rationality and math suddenly dawned on everyone, and the nervous traders got squeezed out. Before the closing bell, WFC had rallied to a new 52-week high.

Then on Wednesday, it was as if rationality and math suddenly dawned on everyone, and the nervous traders got squeezed out. Before the closing bell, WFC had rallied to a new 52-week high.